Tax Force

Accounting, 7052 Santa Teresa BLVD, San Jose, California, 95139, United States, 1-10 Employees

Phone Number: +14*********

Phone Number: +14*********

Who is TAX FORCE

At Tax Force Inc, we take pride in giving you the assurance that the personal assistance you receive comes from years of advanced training, technical experience and financial acumen. Our ...

Read More

-

Headquarters: 7052 Santa Teresa BLVD, San Jose, California, 95139, United States

-

Date Founded: 2013

-

Employees: 1-10

-

Revenue: $1 Million to $5 Million

-

Active Tech Stack: See technologies

-

CEO: Force Inc

Industry: Accounting

SIC Code: 7291

|

NAICS Code: 999990 |

Show More

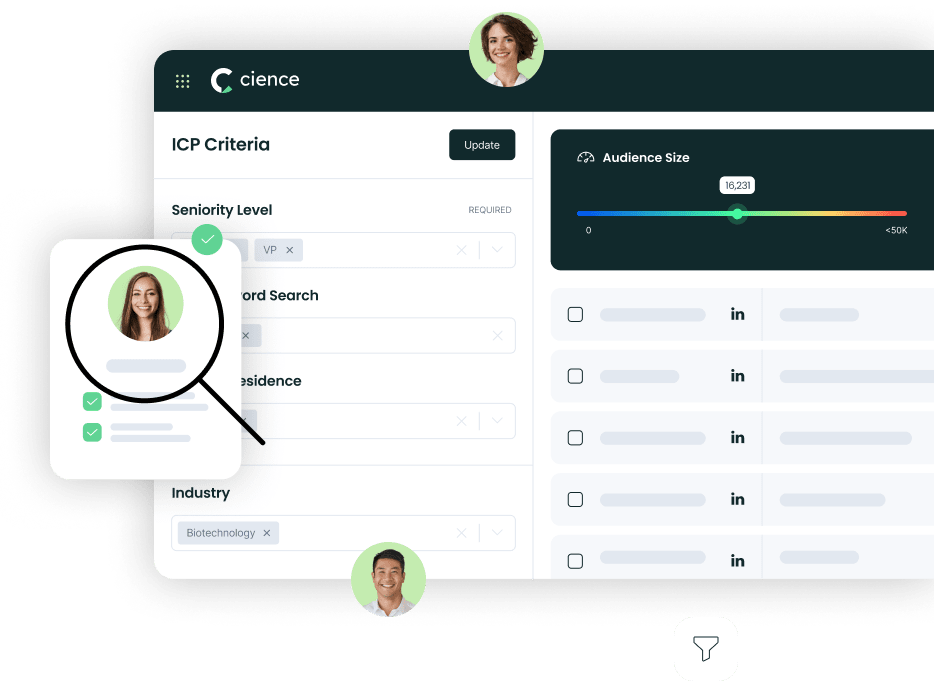

Sign in to CIENCE GO Data to uncover contact details

Free credits every month

Frequently Asked Questions Regarding Tax Force

Answer: Tax Force's headquarters are located at 7052 Santa Teresa BLVD, San Jose, California, 95139, United States

Answer: Tax Force's phone number is +14*********

Answer: Tax Force's official website is https://taxforceinc.com

Answer: Tax Force's revenue is $1 Million to $5 Million

Answer: Tax Force's SIC: 7291

Answer: Tax Force's NAICS: 999990

Answer: Tax Force has 1-10 employees

Answer: Tax Force is in Accounting

Answer: Tax Force contact info: Phone number: +14********* Website: https://taxforceinc.com

Answer: At Tax Force Inc, we take pride in giving you the assurance that the personal assistance you receive comes from years of advanced training, technical experience and financial acumen. Our cloud accounting capability, combined with the benefits of being enrolled directly with the IRS and not on a state level, has allowed us to add clients from various states across the country. You have access to all of your tax information from anywhere you have access to the internet. Your documents are backed up on the cloud. What is the difference between a Certified Public Accountant (CPA) and an Enrolled Agent (EA)? An EA advises and represents individuals, prepares tax returns for individuals, businesses, estates, trusts, & any entities with tax-reporting requirements. The expertise of EAs in the ever changing field of taxation enables them to effectively represent individuals & businesses audited by the IRS. For an EA, tax is their only focus. A CPA, on the other hand, splits their focus between many varied aspects of accounting, one of which is tax. Simply stated, the definition of an EA is "one who is recognized by the IRS as a tax expert." Enrolled Agents are the only federally authorized tax professionals! CPAs are licensed on the state level. Why wouldnt you go to a tax professional for a tax issue and to an accountant for an accounting issue?

Premium Sales Data for Prospecting

-

Sales data across over 200M records

-

Up-to-date records (less decayed data)

-

Accurate Email Lists (real-world tested)

-

Powerful search engine and intuitive interface