Sw Asset Management

Financial Services, 23 Corporate PLZ Dr, Newport Beach, California, 92660, United States, 1-10 Employees

Phone Number: +18*********

Phone Number: +18*********

Who is SW ASSET MANAGEMENT

FIRM OVERVIEW Headquartered in Newport Beach, California, SW Asset Management is a global fixed-income manager, primarily focused on emerging market corporate debt securities. Each of the...

Read More

-

Headquarters: 23 Corporate PLZ Dr, Newport Beach, California, 92660, United States

-

Date Founded: 2009

-

Employees: 1-10

-

Revenue: $1 Million to $5 Million

-

Active Tech Stack: See technologies

Industry: Financial Services

SIC Code: 8741

Does something look wrong? Fix it. | View contact records from SW ASSET MANAGEMENT

SW Asset Management Org Chart and Mapping

Sign in to CIENCE GO Data to uncover contact details

Free credits every month

Frequently Asked Questions Regarding SW Asset Management

Answer: SW Asset Management's headquarters are located at 23 Corporate PLZ Dr, Newport Beach, California, 92660, United States

Answer: SW Asset Management's phone number is +18*********

Answer: SW Asset Management's official website is https://sw-assetmanagement.com

Answer: SW Asset Management's revenue is $1 Million to $5 Million

Answer: SW Asset Management's SIC: 8741

Answer: SW Asset Management has 1-10 employees

Answer: SW Asset Management is in Financial Services

Answer: SW Asset Management contact info: Phone number: +18********* Website: https://sw-assetmanagement.com

Answer: FIRM OVERVIEW Headquartered in Newport Beach, California, SW Asset Management is a global fixed-income manager, primarily focused on emerging market corporate debt securities. Each of the principals has extensive institutional buy-side credit experience with leading asset management firms. The co-founders have successfully managed credit portfolios together since 2006. INVESTMENT STRATEGY As an opportunistic long/short global credit manager, SW Asset Managements investment strategy is non-directional and will have net long bias in most environments. SWs approach to management is truly global and is well positioned to capitalize on the growing corporate credit markets outside of the United States and Western Europe. SW believes that emerging market corporate bonds are an ignored and under-appreciated area of the credit markets and that few established managers have the capabilities needed to exploit this opportunity set. SW also utilizes credit instruments to hedge the volatility of its long holdings. SW Asset Managements edge is its extensive emerging market corporate debt experience as well as the ability to identify imbalances in the credit markets and to proactively hedge large downside risks.

Answer:

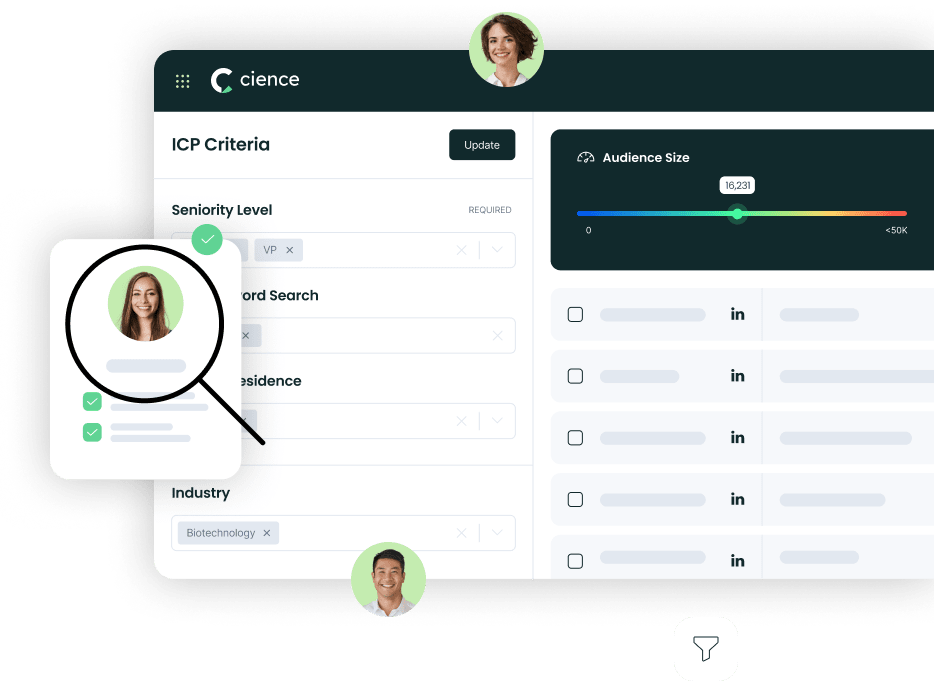

Premium Sales Data for Prospecting

-

Sales data across over 200M records

-

Up-to-date records (less decayed data)

-

Accurate Email Lists (real-world tested)

-

Powerful search engine and intuitive interface

Sign in to CIENCE GO Data to uncover contact details

Free credits every month