Structural Capital

Venture Capital & Private Equity, 400 Oyster Point BLVD Ste 229, Menlo Park, California, 94080, United States, 11-50 Employees

Phone Number: 41********

Phone Number: 41********

Who is STRUCTURAL CAPITAL

Approaching strategic financing from a venture capital and operator viewpoint, not a commercial lender. Founded in 2014 and led by Kai Tse and Larry Gross, Structural Capital is an invest...

Read More

-

Headquarters: 400 Oyster Point BLVD Ste 229, Menlo Park, California, 94080, United States

-

Date Founded: 2014

-

Employees: 11-50

-

Revenue: $1 Million to $5 Million

-

Active Tech Stack: See technologies

Industry: Venture Capital & Private Equity

SIC Code: 6771

|

NAICS Code: 523910 |

Show More

Does something look wrong? Fix it. | View contact records from STRUCTURAL CAPITAL

Structural Capital Org Chart and Mapping

Sign in to CIENCE GO Data to uncover contact details

Free credits every month

Frequently Asked Questions Regarding Structural Capital

Answer: Structural Capital's headquarters are located at 400 Oyster Point BLVD Ste 229, Menlo Park, California, 94080, United States

Answer: Structural Capital's phone number is 41********

Answer: Structural Capital's official website is https://structuralcapital.com

Answer: Structural Capital's revenue is $1 Million to $5 Million

Answer: Structural Capital's SIC: 6771

Answer: Structural Capital's NAICS: 523910

Answer: Structural Capital has 11-50 employees

Answer: Structural Capital is in Venture Capital & Private Equity

Answer: Structural Capital contact info: Phone number: 41******** Website: https://structuralcapital.com

Answer: Approaching strategic financing from a venture capital and operator viewpoint, not a commercial lender. Founded in 2014 and led by Kai Tse and Larry Gross, Structural Capital is an investment firm providing expansion stage loans to venture capital and private equity-backed companies in the technology sector. Structural Capital provides flexible financing solutions to high-growth sponsor-backed companies seeking a less dilutive source of expansion capital. Structural Capital offers a unique and differentiated approach to credit investing stemming from its deep understanding of companies, industries, and relationships with equity sponsors which allows it to provide both competitive tailored financing and value added portfolio company assistance. The Managing Partners have 70+ years of combined experience and have invested over $2 billion of capital in debt and equity transactions in tech-related companies, helping management teams and investors alike to create more enterprise value and boosting returns. Structural Capital is headquartered in Menlo Park, CA.

Answer:

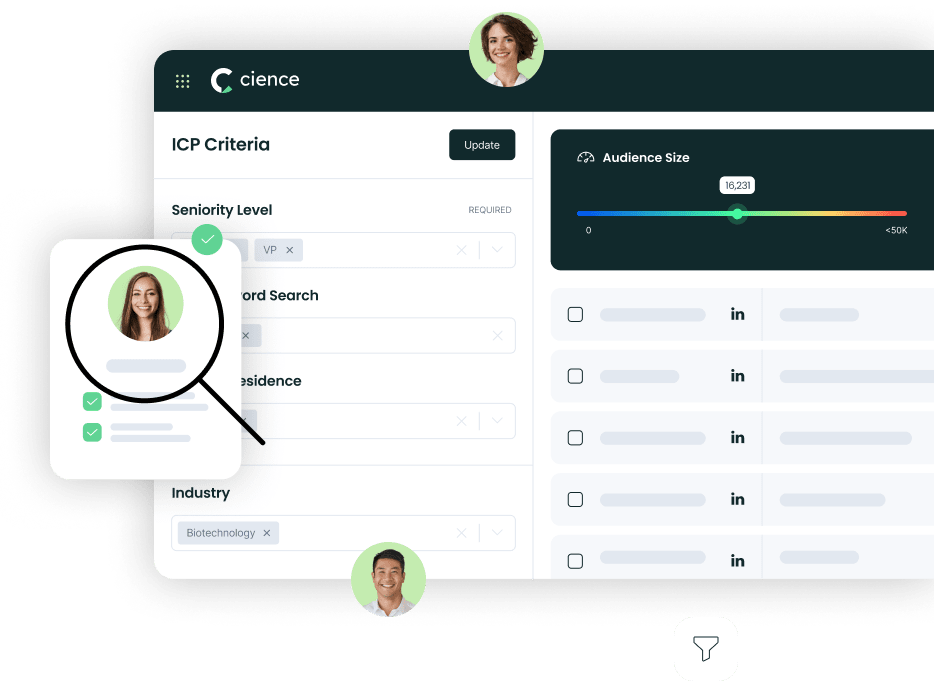

Premium Sales Data for Prospecting

-

Sales data across over 200M records

-

Up-to-date records (less decayed data)

-

Accurate Email Lists (real-world tested)

-

Powerful search engine and intuitive interface

Sign in to CIENCE GO Data to uncover contact details

Free credits every month