Riata Capital Group

Venture Capital & Private Equity, 4550 Travis St, Dallas, Texas, 75205, United States, 11-50 Employees

Phone Number: +16*********

Phone Number: +16*********

Who is RIATA CAPITAL GROUP

RCG is a leading Dallas-based private equity investment firm that partners with seasoned management teams to invest in growing, profitable, privately held companies with a focus on three ...

Read More

-

Headquarters: 4550 Travis St, Dallas, Texas, 75205, United States

-

Date Founded: 2016

-

Employees: 11-50

-

Revenue: $10 Million to $25 Million

-

Active Tech Stack: See technologies

Industry: Venture Capital & Private Equity

SIC Code: 6799

|

NAICS Code: 523150 |

Show More

Does something look wrong? Fix it. | View contact records from RIATA CAPITAL GROUP

Riata Capital Group Org Chart and Mapping

Similar Companies to Riata Capital Group

BWCP, LP

-

1-10

-

$ 1 Million to 5 Million

Fortress Investment Group

-

501-1000

-

$ 250 Million to 500 Million

Gauge Capital

-

11-50

-

$ 10 Million to 25 Million

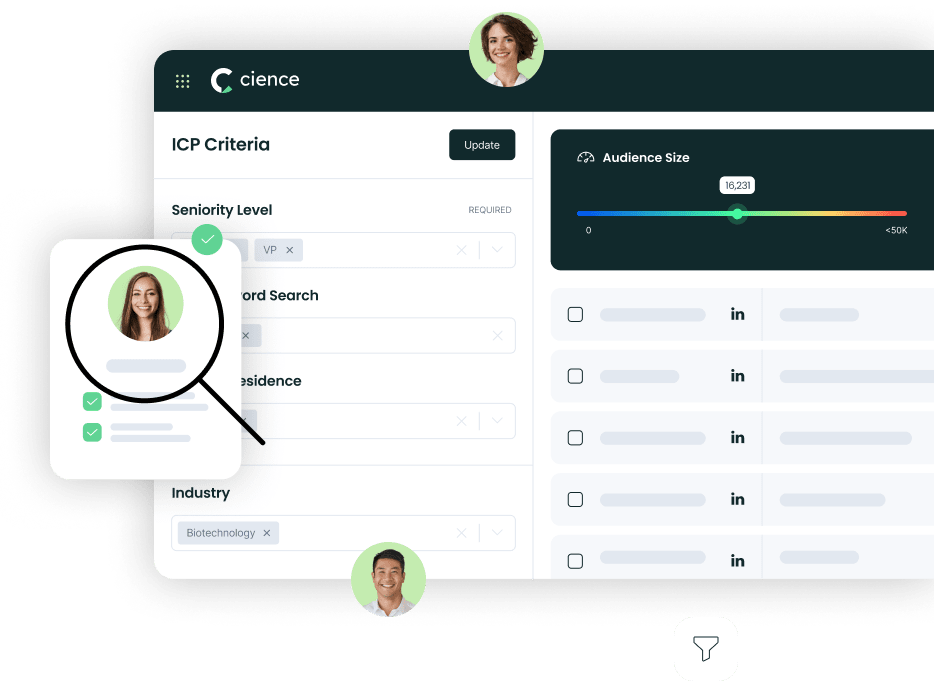

Sign in to CIENCE GO Data to uncover contact details

Free credits every month

Frequently Asked Questions Regarding Riata Capital Group

Answer: Riata Capital Group's headquarters are located at 4550 Travis St, Dallas, Texas, 75205, United States

Answer: Riata Capital Group's phone number is +16*********

Answer: Riata Capital Group's official website is https://riatacapital.com

Answer: Riata Capital Group's revenue is $10 Million to $25 Million

Answer: Riata Capital Group's SIC: 6799

Answer: Riata Capital Group's NAICS: 523150

Answer: Riata Capital Group has 11-50 employees

Answer: Riata Capital Group is in Venture Capital & Private Equity

Answer: Riata Capital Group top competitors include: BWCP, LP , Fortress Investment Group , Gauge Capital

Answer: Riata Capital Group contact info: Phone number: +16********* Website: https://riatacapital.com

Answer: RCG is a leading Dallas-based private equity investment firm that partners with seasoned management teams to invest in growing, profitable, privately held companies with a focus on three industry sectors: business services, consumer, and healthcare services. The firm takes a selective approach to investing in high-potential businesses whose owners and management teams want an investment partner with the capital, experience, and track record of successful collaboration required to achieve their liquidity and value-creation objectives. Over the course of their 25-year careers, the principals of RCG have deployed over $2 billion of capital into more than 45 platform investments and 200 add-on acquisitions totaling in excess of $6.9 billion in transaction value. The firm targets equity investments of $25-150 million in companies with $5-30 million of EBITDA.

Answer:

Premium Sales Data for Prospecting

-

Sales data across over 200M records

-

Up-to-date records (less decayed data)

-

Accurate Email Lists (real-world tested)

-

Powerful search engine and intuitive interface

Sign in to CIENCE GO Data to uncover contact details

Free credits every month