Oz Impact Funds

Real Estate, 1371 East 2100 South, Salt Lake City, Utah, 84105, United States, 1-10 Employees

Phone Number: +18*********

Phone Number: +18*********

Who is OZ IMPACT FUNDS

How it works: The 2017 Tax Cuts and Jobs Act created a powerful new tool for community development and investment in underserved communities throughout the United States called Qualified ...

Read More

-

Headquarters: 1371 East 2100 South, Salt Lake City, Utah, 84105, United States

-

Date Founded: 2018

-

Employees: 1-10

-

Revenue: $5 Million to $10 Million

-

Active Tech Stack: See technologies

Industry: Real Estate

Does something look wrong? Fix it. | View contact records from OZ IMPACT FUNDS

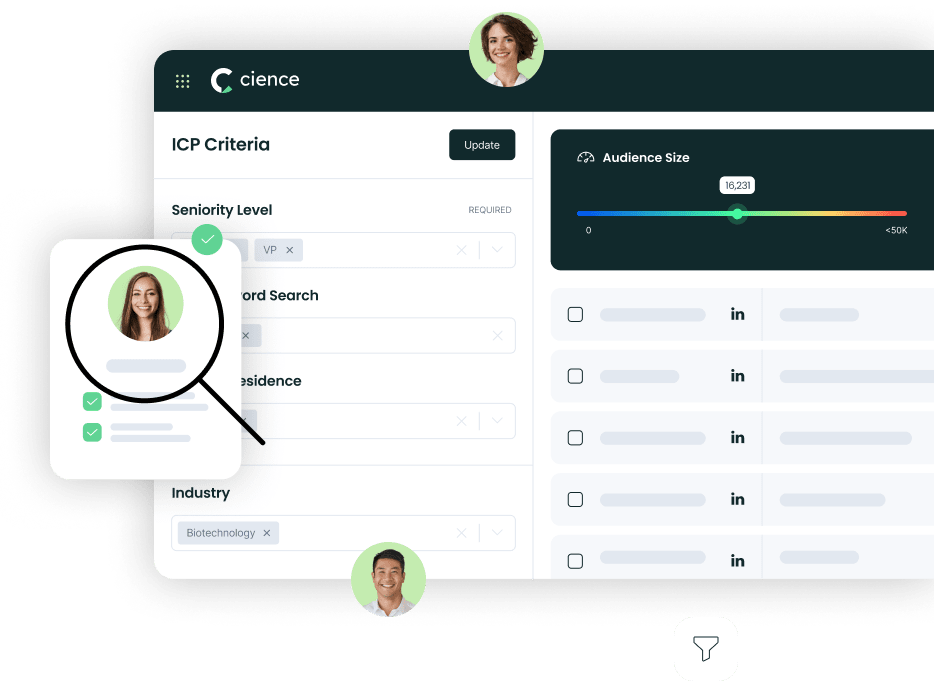

Sign in to CIENCE GO Data to uncover contact details

Free credits every month

Frequently Asked Questions Regarding OZ Impact Funds

Answer: OZ Impact Funds's headquarters are located at 1371 East 2100 South, Salt Lake City, Utah, 84105, United States

Answer: OZ Impact Funds's phone number is +18*********

Answer: OZ Impact Funds's official website is https://ozimpactfunds.com

Answer: OZ Impact Funds's revenue is $5 Million to $10 Million

Answer: OZ Impact Funds has 1-10 employees

Answer: OZ Impact Funds is in Real Estate

Answer: OZ Impact Funds contact info: Phone number: +18********* Website: https://ozimpactfunds.com

Answer: How it works: The 2017 Tax Cuts and Jobs Act created a powerful new tool for community development and investment in underserved communities throughout the United States called Qualified Opportunity Zones (QOZs). The Opportunity Zones provision is intended to achieve long-term private sector investments (+10 years) in distressed communities throughout the country. Investors who reinvest unrealized capital gains into low-income urban and rural communities through qualified opportunity funds (QOFs) may receive a series of tax incentives tied to long-term investment in the QOFs. OZ Impact Funds has established several QOFs for projects and asset classes that demonstrate strong real estate fundamentals while furthering the policy objectives of the QOZ legislation Gain Deferral: Investors who realize ANY capital gain (sale of a company, stock, property, etc.) and invest in QOFs may defer paying taxes on these gains for up to 7 years. To qualify for the maximum deferral, the deferred gain must be recognized on the earlier date of when the Fund interest is sold or December 31, 2026. Partial Reduction: After 5 years of holding assets in a QOF, investors qualify for a 10% step-up in basis on their original gain; after an additional 2 years (total of seven), investors qualify for a total step-up of 15%. To qualify for the maximum 15% tax exclusion on the original capital gains, investors must invest by December 31, 2019. Forgiveness of Additional Gains: After 10 years of investment in a QOF, any appreciation on the original fund investment may be entitled to permanent exclusion from taxable income of all capital gains related to the sale or exchange of QOZ assets (i.e. tax-free growth on investment).

Answer:

Premium Sales Data for Prospecting

-

Sales data across over 200M records

-

Up-to-date records (less decayed data)

-

Accurate Email Lists (real-world tested)

-

Powerful search engine and intuitive interface

Sign in to CIENCE GO Data to uncover contact details

Free credits every month