Infrastructure Capital Advisors

Investment Management, 1325 Ave of the Americas, New York, 10019, United States, 1-10 Employees

Phone Number: +12*********

Phone Number: +12*********

Who is INFRASTRUCTURE CAPITAL ADVISORS

Infrastructure Capital Advisors, LLC (ICA) is an SEC-registered investment adviser that manages exchange traded funds (ETFs) and a series of hedge funds. The firm was formed in 2012 and i...

Read More

-

Headquarters: 1325 Ave of the Americas, New York, New York, 10019, United States

-

Date Founded: 2012

-

Employees: 1-10

-

Revenue: Under $1 Million

-

Active Tech Stack: See technologies

Industry: Investment Management

SIC Code: 6722; 8211

Does something look wrong? Fix it. | View contact records from INFRASTRUCTURE CAPITAL ADVISORS

Infrastructure Capital Advisors Org Chart and Mapping

Sign in to CIENCE GO Data to uncover contact details

Free credits every month

Frequently Asked Questions Regarding Infrastructure Capital Advisors

Answer: Infrastructure Capital Advisors's headquarters are located at 1325 Ave of the Americas, New York, 10019, United States

Answer: Infrastructure Capital Advisors's phone number is +12*********

Answer: Infrastructure Capital Advisors's official website is https://infracapfunds.com

Answer: Infrastructure Capital Advisors's revenue is Under $1 Million

Answer: Infrastructure Capital Advisors's SIC: 6722; 8211

Answer: Infrastructure Capital Advisors has 1-10 employees

Answer: Infrastructure Capital Advisors is in Investment Management

Answer: Infrastructure Capital Advisors contact info: Phone number: +12********* Website: https://infracapfunds.com

Answer: Infrastructure Capital Advisors, LLC (ICA) is an SEC-registered investment adviser that manages exchange traded funds (ETFs) and a series of hedge funds. The firm was formed in 2012 and is based in New York City. ICA seeks total-return opportunities driven by catalysts, largely in key infrastructure sectors. These sectors include energy, real estate, transportation, industrials and utilities. We often identify opportunities in entities that are not taxed at the entity level, such as master limited partnerships ("MLPs") and real estate investment trusts ("REITs"). We also look for opportunities in credit and related securities, such as preferred stocks. Current income is a primary objective in most, but not all, of ICA's investing activities. Consequently, the focus is generally on companies that generate and distribute substantial streams of free cash flow. This approach is based on the belief that tangible assets that produce free cash flow have intrinsic values that are unlikely to deteriorate over time.

Answer:

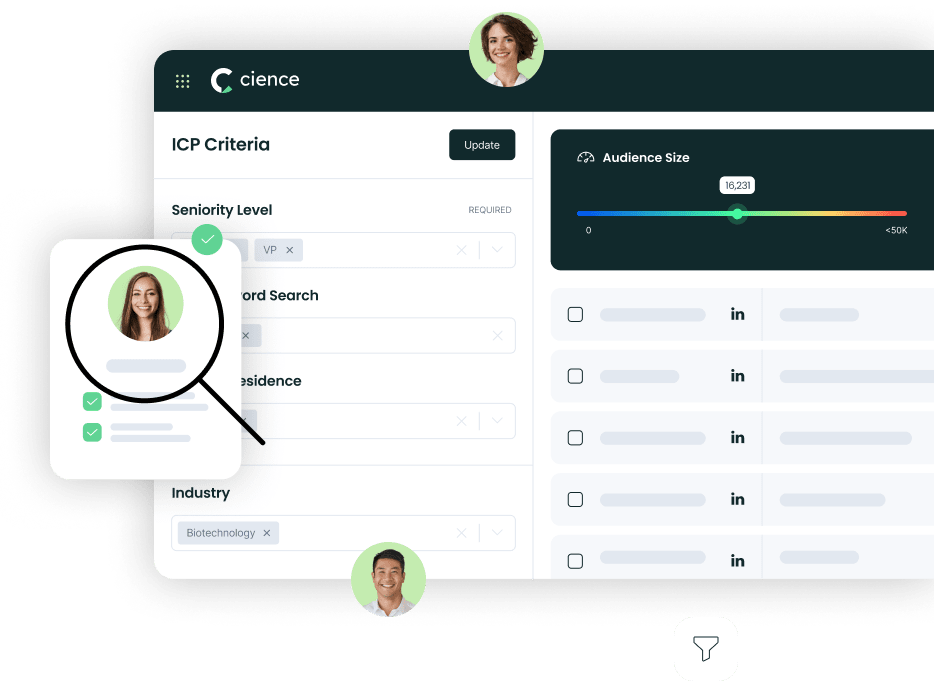

Premium Sales Data for Prospecting

-

Sales data across over 200M records

-

Up-to-date records (less decayed data)

-

Accurate Email Lists (real-world tested)

-

Powerful search engine and intuitive interface

Sign in to CIENCE GO Data to uncover contact details

Free credits every month