Hickory Lane Capital Management

Investment Management, 530 Fashion Ave, New York, 10018, United States, 1-10 Employees

Who is HICKORY LANE CAPITAL MANAGEMENT

Hickory Lane Capital Management LP (Hickory Lane or the Firm) is a fundamentals-based equity asset manager that employs a multi-disciplinary approach to generate strong risk-adjusted retu...

Read More

-

Headquarters: 530 Fashion Ave, New York, New York, 10018, United States

-

Date Founded: 2020

-

Employees: 1-10

-

Revenue: $1 Million to $5 Million

-

Active Tech Stack: See technologies

Industry: Investment Management

Does something look wrong? Fix it. | View contact records from HICKORY LANE CAPITAL MANAGEMENT

Hickory Lane Capital Management Org Chart and Mapping

Sign in to CIENCE GO Data to uncover contact details

Free credits every month

Frequently Asked Questions Regarding Hickory Lane Capital Management

Answer: Hickory Lane Capital Management's headquarters are located at 530 Fashion Ave, New York, 10018, United States

Answer: Hickory Lane Capital Management's official website is https://hickorylane.com

Answer: Hickory Lane Capital Management's revenue is $1 Million to $5 Million

Answer: Hickory Lane Capital Management has 1-10 employees

Answer: Hickory Lane Capital Management is in Investment Management

Answer: Hickory Lane Capital Management contact info: Phone number: Website: https://hickorylane.com

Answer: Hickory Lane Capital Management LP (Hickory Lane or the Firm) is a fundamentals-based equity asset manager that employs a multi-disciplinary approach to generate strong risk-adjusted returns on longs and shorts. The Firms strategy is centered on i) long-term bottom-up investing, ii) top-down analysis, and iii) rigorous risk management. Hickory Lane approaches investing from a balance sheet perspective, ensuring an understanding of how the capital structure affects equity value. The Firms shorts seek to hedge idiosyncratic risks directly related to the long portfolio. For the long portfolio, Hickory Lane seeks companies that exhibit the following characteristics: (i) high-quality business, (ii) favorable sector dynamics, (iii) stellar management team, (iv) strong free cash flow generation and balance sheet, and (v) attractive valuation. The short portfolio is comprised of hedges meant to mitigate risks directly associated with the longs, including: (i) company-specific, (ii) sector, and (iii) market. Individual shorts exhibit issues associated with their (i) business, (ii) financial performance, (iii) management team, or (iv) valuation.

Answer:

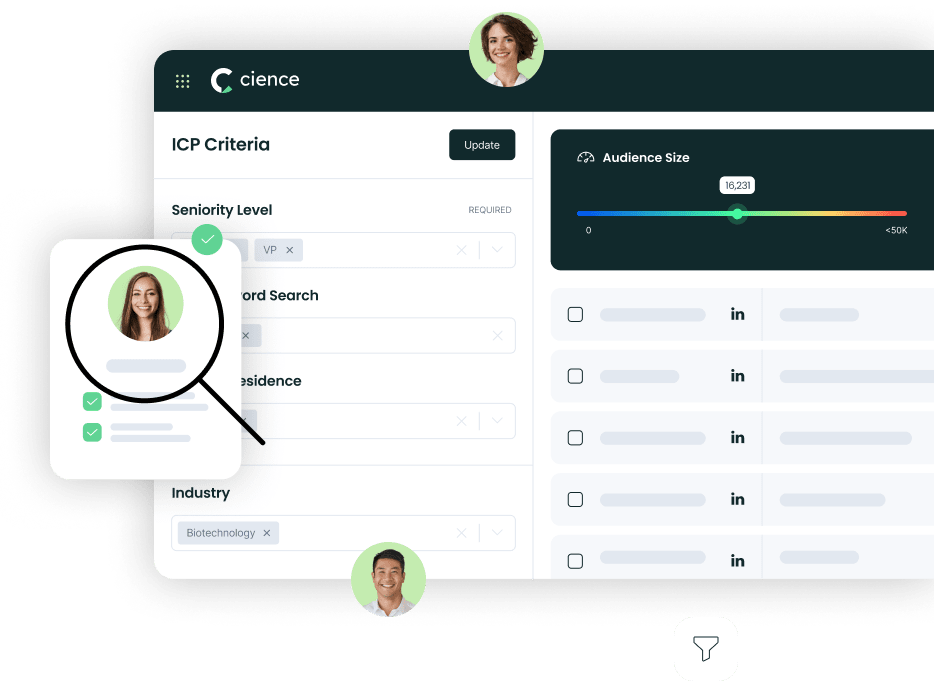

Premium Sales Data for Prospecting

-

Sales data across over 200M records

-

Up-to-date records (less decayed data)

-

Accurate Email Lists (real-world tested)

-

Powerful search engine and intuitive interface

Sign in to CIENCE GO Data to uncover contact details

Free credits every month