Bahamdan Group

Investment Management, 112 116 Al Dugaither CTR, Riyadh, New York, 11561, United States, 11-50 Employees

Who is BAHAMDAN GROUP

Our activities are undertaken by three investment arms - the Bahamdan, Safanad and Arcola. While Bahamdan Group makes and manages local investments in Saudi Arabia and across the MENA reg...

Read More

-

Headquarters: 112 116 Al Dugaither CTR, Riyadh, New York, 11561, United States

-

Date Founded: 1955

-

Employees: 11-50

-

Revenue: $1 Million to $5 Million

-

Active Tech Stack: See technologies

Industry: Investment Management

Does something look wrong? Fix it. | View contact records from BAHAMDAN GROUP

Sign in to CIENCE GO Data to uncover contact details

Free credits every month

Frequently Asked Questions Regarding Bahamdan Group

Answer: Bahamdan Group's headquarters are located at 112 116 Al Dugaither CTR, Riyadh, New York, 11561, United States

Answer: Bahamdan Group's official website is https://bahamdan.com

Answer: Bahamdan Group's revenue is $1 Million to $5 Million

Answer: Bahamdan Group has 11-50 employees

Answer: Bahamdan Group is in Investment Management

Answer: Bahamdan Group contact info: Phone number: Website: https://bahamdan.com

Answer: Our activities are undertaken by three investment arms - the Bahamdan, Safanad and Arcola. While Bahamdan Group makes and manages local investments in Saudi Arabia and across the MENA region, Safanad, which was established with the backing of Bahamdan in 2009, is a global principal investment vehicle used to execute and manage the Groups global assets including investments in real estate, private equity and public markets. Safanad was created at a time of market dislocation to exploit opportunities following the global financial crisis. It is a hybrid of a family office, endowment and asset manager, taking the best characteristics of each. Arcola acts as a supporting entity, serving as the Groups liquidity and wealth management platform and the manager of its investments into global securities. Today the Group has investments across multiple asset classes and industries including substantial holdings in the financial services, education, healthcare, real estate, telecommunications and media, aviation, industrial and construction sectors. While we have become seasoned investors in each of these areas, the Group has particularly deep roots in the financial services and investment arena. Importantly, it is this heritage that informs our views, shapes our approach and enhances our ability to effectively structure and manage our investments across sectors. Also supporting our ability to unlock value from the assets in which we invest is our strong knowledge of both regional and international markets and the access we provide to a broad network of industry experts around the world. Our investments, which are made independently and alongside well respected partners, range from start-up ventures to established growth businesses and turnaround situations, which not only require capital but access to the expertise, know-how and business acumen that defines Bahamdan and have allowed us to establish ourselves as a strategic global investor over the past 60 years.

Answer:

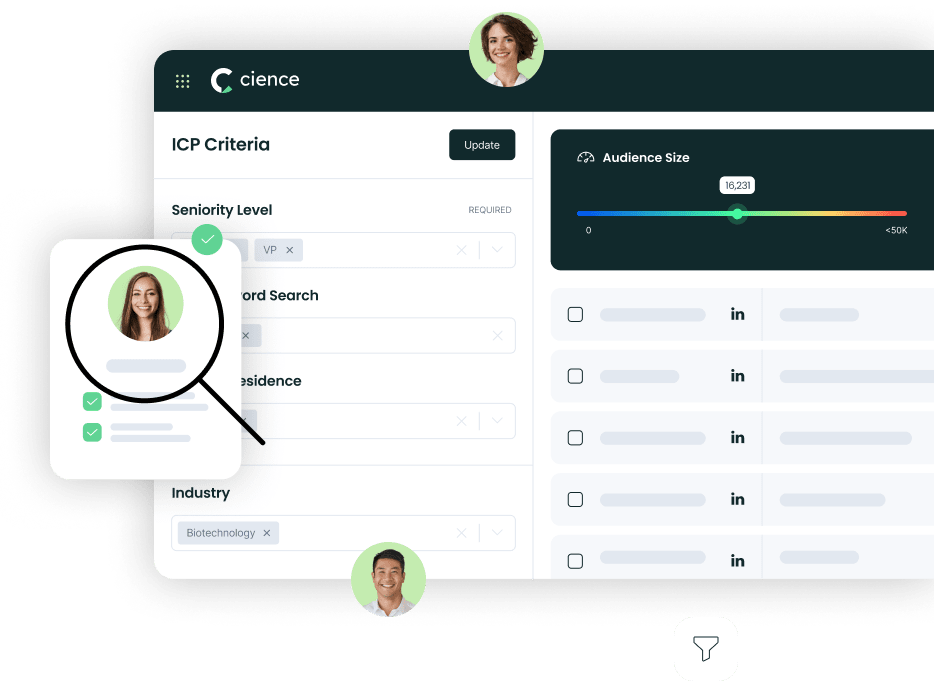

Premium Sales Data for Prospecting

-

Sales data across over 200M records

-

Up-to-date records (less decayed data)

-

Accurate Email Lists (real-world tested)

-

Powerful search engine and intuitive interface

Sign in to CIENCE GO Data to uncover contact details

Free credits every month